In Pursuit of Profit

Read our expert article below or sign up to get articles sent to your inbox.

|

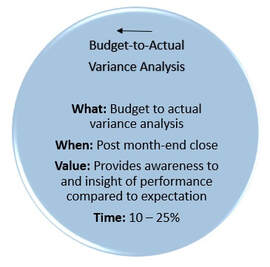

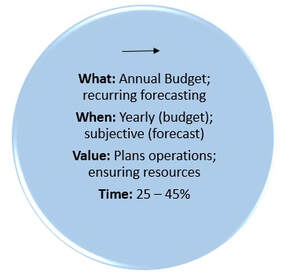

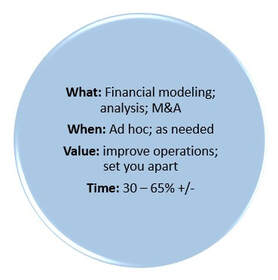

“Finance” is a broad term every business leader has heard, but it can mean many different things. Businesses have banking relationships, investments they need to track, fundraising and financial analysis needs. Corporate Financial Planning and Analysis (FP&A), the work performed by Financial Analysts, is a complex specialty within Finance that all successful businesses need in some degree. There are multiple FP&A components of which every business requires a different combination. This complexity makes hiring to satisfy your FP&A needs difficult. To make matters harder, many accounting and FP&A functions can overlap. So how do you know if you need to hire a dedicated Financial Analyst or a hybrid accountant? It helps to first understand the components of Corporate FP&A, the value each adds, and how much time each activity should take.  The Key Components of FP&A As a trained accountant who learned the ins and outs of Corporate FP&A on the job, it’s taken me years to derive a simplistic view of it to share with trusted clients. At its core, there are three components to FP&A that can be visualized in overlapping circles. Each circle represents a distinct FP&A skill that different Financial Analysts have experience with. The first involves looking in arrears: post-close budget to actual variance analysis. This is the process of telling the story of what happened financially in a business in the period after the last close of the books: what was the expectation (budget), what actually happened (actual) and why (variance analysis). It involves an intimate knowledge of what was sold or not sold and why, what operating expenses were over/under budget and why, what strange expenses popped up in the month, and any other transactions that stood out compared to what was budgeted for that period. Only someone with ability to understand accounting level transactions can dig into the reasoning behind these variances. This is hugely valuable to business leaders because as it allows them measure performance compared to expectation and make the needed operational adjustments. This process can take anywhere from 2-5 days/month, or 10-25% of an employee’s time.  The second is forward-looking: recurring budgeting and forecasting. Most businesses go through a yearly budget cycle projecting revenues and expenses at different levels of detail congruent with their business needs. Forecasting is both an updated budget at any given point throughout the year – some businesses reforecast monthly and some only once per year – and can be specific to certain important measures like cashflow forecasting. There are many benefits to engaging in detailed budgeting and forecasting, though in its simplest form, it helps you plan your business operations for an upcoming period, helps set targets and ensures you have the required resources and can hit these targets. These can be long and laborious processes depending on the complexity of a business. The budget process alone can take 2-4 months to complete, while forecasting is very subjective, so a wide estimated range of time is between 25-45% of an employee’s time.  The third is the “catch-all” circle: where the rest of Corporate FP&A falls. This is the project work, or “the sexy stuff”, because most Financial Analysts highly prefer this work over the other two buckets. Many tasks can fall into this category, though some common responsibilities are:

This work is important for two reasons: it can help support and improve recurring operations (pricing and ROI analysis, M&A), and it can set you apart from your competitors by helping to improve profitability or reduce costs (KPI creation, data visualization, lean projects). It’s not easy to decide/dictate how much time this bucket will take. That depends on how much of this project work you, as a business leader, feel you need. If we’re doing math, a dedicated employee would have 30-65% of their time to spend on this work after completing buckets one and two. Perhaps, though, you have more or less need for this work than that. It’s helpful to view the circles together as overlapping as many Financial Analysts have strengths in the middle circle and either variance analysis or budgeting/forecasting. A strong Financial Analyst’s skills will overlap. So how do you know what specific total FP&A needs you have? Understanding the State of your Business You can identify indicators of a need for any of the three FP&A skill sets through understanding the current state of your business. Clearly you have an FP&A need if any of the work in the three buckets above are not happening at all, taking much too long, or not occurring timely enough to provide value to your business. For example, a budget is only useful if it’s completed prior to the beginning of the year it is meant to plan. Monthly variance analysis is meant to provide insight immediately following the monthly close of the books to allow for changes to be made timely. And the “sexy stuff” project work is considered ad hoc but is often the result of an immediate business need. Your business may also be growing or going through a material change such as:

Hiring for your FP&A Needs Every business with an existing accounting workforce has three options when addressing their FP&A needs:

When you are ready to hire a financial analyst or hybrid accountant, reach out to us for assistance. We work with companies of all sizes across all industries in the Pacific Northwest.  About the Author: Quinn Finnigan has been working in Accounting and Finance for over 15 years. After ten years in industry accounting, he actively sought out the recruiting industry in 2015, seeking to redefine his career success definition. He has served Puget Sound-based middle market companies to fill Accounting and Finance positions through contingent placements for over five years. A proud alumnus of The University of Portland, he received his undergraduate degree in Accounting. He began his career at Deloitte in the audit practice for three years before taking a "quarter-life crisis" break to live and play in Maui. After stints in corporate accounting and finance at the Seattle Seahawks and Amazon, he decided to help fellow accountants find jobs in accounting. Having found his passion and expertise, he greatly enjoys serving Pacific Northwest-based organizations with ASP and CFO Selections. More about Quinn> |

SUBSCRIBE:DOWNLOAD:DOWNLOAD:Categories:

All

Archives:

July 2024

|

Services |

Company |

|

6/18/2021