In Pursuit of Profit

Read our expert article below or sign up to get articles sent to your inbox.

When you think of teams that help build and sustain company culture, which teams come to mind? Human Resources? Marketing? Sales? Customer service maybe? These areas of the company are typically entrusted with developing and propagating a culture that encourages employees to do their best work, helps the organization achieve its objectives, and looks good to customers and key stakeholders. But what about accounting and finance? These departments tend to be overlooked when a company is building its workplace culture. To understand why accounting and finance professionals get passed over when looking for a group to adopt and maintain the culture, it is important to understand what company culture is, why it is important, and how an accounting team is in a unique position to help support it.  As an accounting recruiting firm and financial services provider, we work with businesses everyday who ask, “Should we hire or outsource our accounting needs?” This question is especially important for companies in the startup phase because they likely have significant cash flow concerns to consider. However, startups may also have other unique characteristics that make this question more challenging to answer, such as:

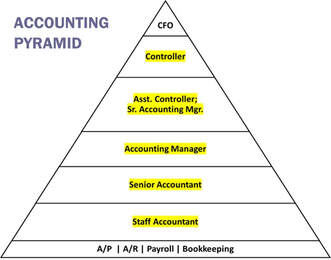

While every business will have their own unique needs and challenges, it is generally best for a startup to outsource their accounting activities initially and then hire internally as their needs change. Where does that shift happen?  Whether your accounting team is employed in-house or outsourced to a third party, the question of whether it will return to the office or continue to work remotely is likely at the top of your mind. Nationwide many companies have returned the office, at least as part of a hybrid work model, but those changes have been the source of stress at various levels. With some workers wanting to go back, others desiring to stay home, and management tasked with keeping everyone happy and productive, this topic is causing friction across the board. But increasing employee satisfaction is not the only factor being considered. More serious issues like financial integrity and risk management are also in jeopardy. Just like the concerns that arose when employees began working from home suddenly at the start of the pandemic, this transition to a permanent remote work pattern has many experts analyzing the implications for financial controls. To understand how these internal controls can become compromised with remote workers, let’s examine the most important accounting controls in your business right now and discuss how you can strengthen them amid a remote work environment:  The accounting pyramid organizes accounting-related job titles into a hierarchy that ranks them by responsibilities and deliverables, with bookkeepers at the bottom, accountants in the middle, and the Chief Financial Officer (CFO) at the top. While it is obvious to most people that bookkeepers are the most entry-level accounting team staff and CFOs are the bosses at the top, there is a lot of confusion in the middle. Understanding the difference between a Staff Accountant, Senior Accountant, and Accounting Manager, is something many business professionals (even hiring managers) do not understand. Many people assume that Staff Accountants and Senior Accountants are individual contributor roles with varying levels of experience and Accounting Managers and Senior Accounting Managers are the people who oversee teams of lower-level accountants. However, that is not a correct understanding of the stratification of roles. To further complicate matters, some people use the titles of Senior Accounting Manager and Controller interchangeably, which adds even more confusion. To provide some clarity on the topic, we will explain what each job title means, how it differs from other adjacent accounting positions, and when you need to hire each role: Don't wait around for "the right time" to improve your accounting functions! Now is the time to stop putting off the planning and cleanup work that always seems to get pushed to the backburner. Commit yourself to embracing a culture of continuous improvement – looking for places where you can overhaul whatever is broken and streamline areas that are not working optimally.

So, how do you identify where your accounting department needs to improve? Ask your accounting team and any staff that deals directly with them where their pain points are and what they would prioritize fixing. By including both the team’s feedback and the rest of the organization’s perspective, you will get more balanced input on what kinds of changes should be prioritized. Focus on operations, processes, and policies with the potential to have a big impact on either efficiency or accuracy. Possible areas to focus on include: |

SUBSCRIBE:DOWNLOAD:DOWNLOAD:Categories:

All

Archives:

July 2024

|

Services |

Company |

|

7/27/2021